2022 Irs Schedule 1 Instructions

If you're searching for 2022 irs schedule 1 instructions pictures information connected with to the 2022 irs schedule 1 instructions topic, you have visit the ideal site. Our site always provides you with suggestions for refferencing the highest quality video and picture content, please kindly surf and find more enlightening video content and images that match your interests.

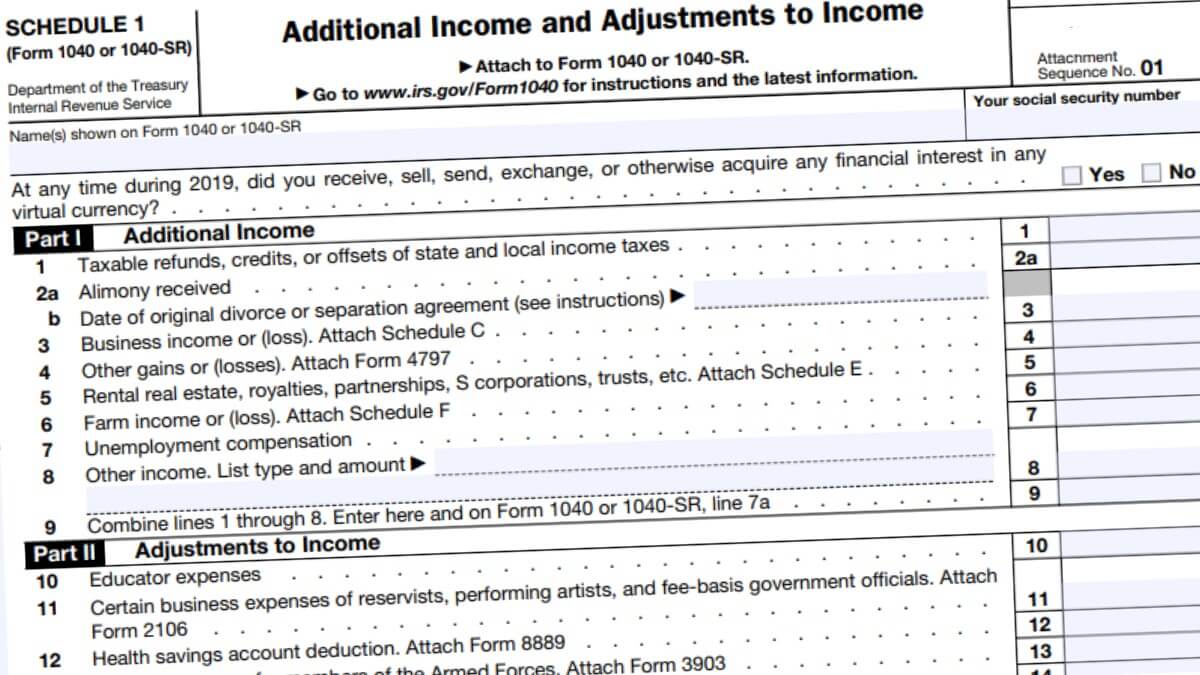

2022 Irs Schedule 1 Instructions. For purposes of schedule r, the term “client” means (a) an “employer or payer” identified on form 2678, employer/payer How to fill out the schedule 1 in 2022, line by line.

Internal revenue service form 1040a is a federal income tax return you can file when you don't want to itemize your. Easily fill out pdf blank, edit, and sign them. 397 rows instructions for schedule i (form 1041) (2021) download pdf.

On page one of irs form 1040, line 8, the taxpayer is asked to add the amount from schedule 1, line 9, additional income.

53 tax credits and deductions you can claim in 2022. Before you file schedule 1, know that you can make adjustments to your income whether you itemize or take the standard deduction. The 2021 efile tax season starts in january 2021. Application for consent to sale of property free of the federal tax lien 0122 01/10/2022 form 14497

If you find this site {adventageous|beneficial|helpful|good|convienient|serviceableness|value}, please support us by sharing this posts to your {favorite|preference|own} social media accounts like Facebook, Instagram and so on or you can also {bookmark|save} this blog page with the title 2022 irs schedule 1 instructions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it's a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.